Malaysia Excise Duty on Cars

Fortunately vehicles from ASEAN countries are not imposed with import duty. KUALA LUMPUR Dec 31 Reuters - Malaysia cut import duties on cars on Wednesday a year ahead of schedule but imposed excise duties of 60-100 percent to help offset the revenue fall.

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It Insights Carlist My

Automotive industry in Malaysia is.

. Meanwhile the import duty can go up to 30 which varies based on the vehicles. Malaysian carmakers like Proton and Perodua are also subject to excise duties and sales tax. Imports local assembly and individual owners.

Sales tax administered in Malaysia is a single stage tax imposed on. Prices for CKD locally assembled cars will increase by between 8-20 if new excise duty regulations are put in place due to a change in methodology of how the open market value OMV of a. Originally new excise duty regulations set by the customs department wouldve increased prices of CKD cars next year but this is no longer the case.

Speaking to FMT Barjoyai Bardai said Malaysia would ultimately have to dismantle all forms of protection for the industry. This was confirmed by the President of Malaysian Automotive Association MAA. It is the excise tax.

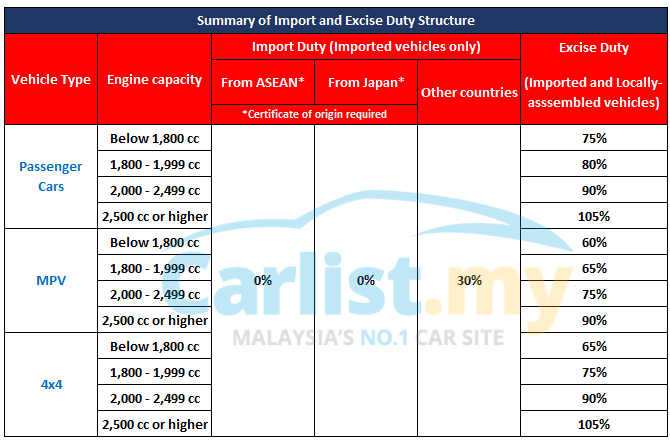

According to Malaysian Automotive Association MAA the excise duty imposed on cars ranges from 65 to 105. Please confirm that you are not a robot. They only apply to full EV vehicles and exclude hybrid vehicles.

On the other hand import duty can reach up to 30 depending on the vehicles country of manufacture. However the Malaysia Automotive Association MAA has since clarified that the tax-free reference only refers to import and excise tax and sales tax exemption only applies to CKD EVs. KUALA LUMPUR Oct 29 -- The government intends to provide full exemption on import and excise duties as well as sales tax for electric vehicles EV to support development of the local EV industry.

The incentives are as follows. In its budget speech they announced a 100 elimination of all taxes on EVs in Malaysia including import and excise duties as well as road tax. Imported CBU EVs have full import and excise duty exemptions until the end of 2023.

What is the excise duty. The prices of locally assembled CKD cars will not increase come 2021. On top of sales tax depending on the car and its engine capacity excise duty is levied between 60 and 105.

Until the government announces any concrete plans on compensating for the shortfall in tax revenue talks of slashing excise duties are best treated as populist moves to shore up support at the expense of businesses and. Here is a quick look at the motor vehicle import and. The 10 percent sales tax still remain for imported CBU vehicles.

The latter is not relevant at the moment because there are no CKD EVs on sale in Malaysia. We have noticed an unusual activity from your IP 207461361 and blocked access to this website. I Taxable goods manufactured in Malaysia by any registered manufacturer.

Car prices are further escalated by the tax rate and excise duty imposed. Excise tax is an additional tax that needs to be paid when purchases are made on a specific item or good. Malaysias EV tax incentives apply to three categories.

Under the present tax structure imported passenger cars are subject to import duties excise duties and sales tax. Sebagai salah satu langkah ke arah meningkatkan kualiti hidup masyarakat dan kawalan terhadap masalah obesiti dan Non-Communicable Diseases NCDs yang semakin meningkat di kalangan rakyat Malaysia Menteri Kewangan melalui pembentangan bajet 2019 pada telah mengumumkan pengenaan duti eksais ke atas minuman bergula atau Sugar Sweetened. At present the excise duty is set at between 60 to 105 for both locally assembled and imported cars and it is calculated based on the car model and engine capacity.

A type of tax imposed on certain goods imported into or manufactured in Malaysia. CBU motor vehicle will subsequently be returned to the franchise AP holder or sent to a dealer appointed by the franchise AP holder after the vehicle has been registered in the RMCD e-excise system and sales tax paid. These are energy-efficient vehicles meant to reduce gas emissions hence to aid the local.

In Malaysia no import duty is imposed for cars originating from Asean countries while 30 import duty is imposed on vehicles imported from non-Asean countries. Aside from the sales tax vehicles sold are also charged with other taxes namely excise duty and import duty. Vehicle will subsequently be returned to the franchise AP holder or sent to a dealer appointed by the franchise AP holder after the vehicle has been registered in the RMCD e-excise system and sales.

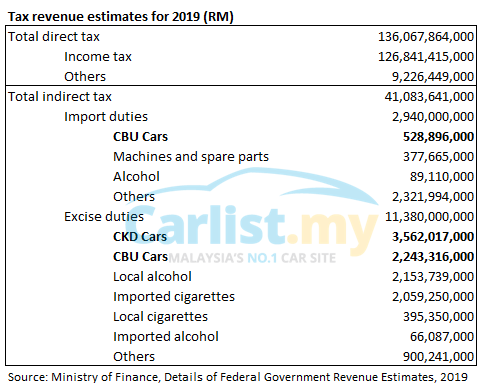

What goods are subject to excise duty. Locally assembled CKD have full. A quick look at Malaysias tax revenue breakdown will tell you how much the Malaysian government relies on taxes on car.

This all changed last week during the governments announcement of the 2022 National Budget last Friday. Cigarettes tobacco and tobacco products. Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz said the road tax exemption of up to 100 per cent will be given for EVs in addition to.

In this case it would be on the imported car. Heres a bit of good news to end the year.

Ckd Vs Cbu What S The Difference

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It Insights Carlist My

Fuel Pump Issue A Must Read For Toyota Honda Car Owners

Five Things To Know About Cars In Malaysia Carsguide Oversteer

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It Insights Carlist My

0 Response to "Malaysia Excise Duty on Cars"

Post a Comment